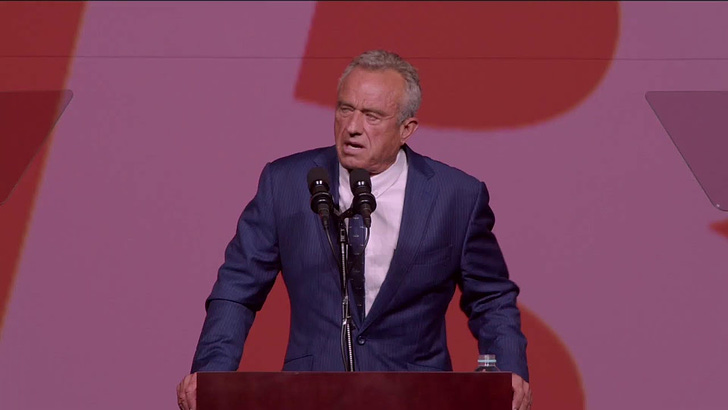

Today, I delivered the following keynote speech at the Bitcoin 2024 conference in Nashville, Tennessee:

I’m glad to be back for my second Bitcoin conference. Since last year, I’ve been meeting with leaders and thinkers from this community. I’ve conferred with miners, policymakers, economists, financial experts, investors, developers, and entrepreneurs to deepen my understanding of the extraordinary promise of Bitcoin for our country and the planet.

After all I’ve learned, I intend as President to sign an executive order directing the Department of Justice and the U.S. Marshals to transfer the approximately 200k Bitcoin held by the U.S. government to the U.S. Treasury where it shall be held as a strategic asset.

On day one as President, I will sign an executive order directing the U.S. Treasury to purchase 550 Bitcoin daily until the U.S. has built a reserve of at least 4 million Bitcoins and a position of dominance that no other country will be able to challenge. Our nation holds approximately 19% of global gold reserves. This policy will give us about the same proportion of total Bitcoin. The cascading effect from these actions will eventually move Bitcoin to a valuation of hundreds of trillions.

On day one as President, I will sign an executive order directing the IRS to issue public guidelines that all transactions between bitcoin and the U.S. dollar are unreportable transactions — and by extension nontaxable.

On day one as President, I will sign an executive order directing the IRS to treat Bitcoin as an eligible asset for 1031 exchange into real property.

Despite their different viewpoints, I've found the most striking feature of the Bitcoin community is a paradoxical juxtaposition marked by fierce divisions on several minor issues and an overwhelming sense of unity within the larger Bitcoin ecosystem. The Bitcoin community reminds me of how American politics should be: fiercely diverse but ultimately united in our aspirations and in our belief in our country and in our convictions that America is worth the fight. And in the end, we come back together, united in our belief that Bitcoin is a technology for freedom, for optimism, for independence, for democracy, for transparency, and for hope. It is the perfect currency: an elegant, poetic, pure species that aligns perfectly with the highest ideals and aspirations represented by the American experiment with self-governance, incorruptible integrity, self-sovereignty, personal responsibility, and accountability. It is decentralized and democratic. It is small on government, and large on personal freedom. Bitcoin is anti-war and a fierce, merciless, and insurmountable foe of government corruption.

It was that incident that led me immediately to grasp the potential this technology had for transactional freedoms and self-sovereignty. Last year at this conference, I proposed that as your President, I would fight to ensure the right to self-custody Bitcoin, to run nodes in our own homes, and to stop the federal government from usurping our First Amendment rights for open source, privacy-enhancing technologies. I pledged to prevent government officials from adopting a CBDC, which would inevitably morph into a malevolent tool for surveillance and control. Most importantly, I promised to secure the United States’s position as the global hub of cryptocurrency innovation, investment, and technology. As a lifelong environmentalist, I embrace Bitcoin as a mechanism for incentivizing greater investments in green and renewable energy production.

After the time I spent with the Bitcoiners last year, I left this conference so enthralled with the optimism of Bitcoin with its potential to eliminate the national debt, as a hedge against inflation, and its promise to guarantee personal freedom, restore the American middle class, and end government corruption, defund the war machine, and to protect our environment, that I placed most of my fees from the Monsanto case — which represented a large portion of my personal wealth — in Bitcoin. I didn’t do that with the hopes of a quick return on investment. But — if that had been my sole motive — I would not have been disappointed.

Over this past year, I’ve gone even further down the orange rabbit hole. I am convinced, now more than ever, that we have to work together to put all those proposals into action. America is at a crossroads: we can either continue down the path we are on — racking up debt, constricting freedom, addicted to war — or we can look forward and use new technologies like Bitcoin to help us evolve and achieve again our promise as a moral authority and the world’s exemplar for incorruptible democratic government.

It appears I’m not the only one talking about Bitcoin in this year’s election. Nothing could make me happier than to see other political leaders now jumping on the Bitcoin bandwagon. I’ve had over a year’s head start to study, understand, and to articulate the potential of Bitcoin. My goal as the first Bitcoin president will be to enact policies that will make America the world’s greatest representative for Bitcoin and a proponent of its democratic values.

I grew up assuming America would long maintain its status as the leader of the free world. But since the collapse of the Soviet Union in 1993, we have paradoxically been moving in a declining spiral away from that role. Hubris, military adventurism, and corruption have put America’s political and economic power in precipitous decline. Our dollar is rapidly losing its reserve currency status because we’ve weaponized it against other countries. When we disagree with the policies of other countries, we kick them out of the SWIFT system and debank them. As a predictable result of that strategy, the BRICS nations are now in the process of de-dollarizing by getting off of the petrodollar. They realize that trading their commodities and other hard resources for money that is printed out of thin air is a losing proposition for them. This trend will likely accelerate until we make the tough transition towards backing our debt obligations with hard assets again.

I have a plan to strengthen the U.S. dollar and lower interest rates and neutralize our $34 trillion debt by backing U.S. Treasury bills, notes, and bonds with hard assets, including a combination of precious metals and bitcoin. Backing U.S. debt obligations by collateralizing them with hard assets not only restores strength to the dollar, it reins in inflation, and ushers in a new era of American financial stability, peace, and prosperity. The world needs to believe that we have safely handcuffed our government’s ability to create money out of thin air with no “proof of work.” This innovative strategy leverages the scarcity and liquidity of Bitcoin — along with gold and other hard assets — to restore the dollar’s dominance in global finance.

The world will rush to adopt an American-backed decentralized currency that cannot be confiscated by governments and that can be traded and transacted on cell phones at the speed of light across every global border with no bank fees or other transactional friction. This incorruptible currency will immediately start pulling wealth and assets from every other nation back into our country, restoring the strength of the dollar and repairing our balance of payments.

Six months before his assassination, my uncle President John F. Kennedy signed an Executive Order that put silver coins in competition with the notes issued by the Fed. His intent was to rein in Fed discretion. He had been a critic of Fed policy and hoped to end discretionary monetary policy and the inevitable debasement of the dollar. He understood that a highly leveraged economy leads directly to the destructive kind of wealth inequality that is today eroding American democracy and generating violence, division, and discontent. Notably, after my uncle’s assassination, the government stopped issuing those silver coins and power returned to the Fed. My uncle apparently understood the potential for the Fed to evolve into a tyranny.

Bitcoin has the potential to return monetary discipline to the Fed and restore the dollar as the unchallenged global reserve currency. And just as Bitcoin can fortify the dollar, it can also secure the U.S.’s position in cyberspace. I understand that tomorrow, President Trump may announce his plan to build a Bitcoin Fort Knox and authorize the U.S. government to buy 1 million bitcoin as a strategic reserve asset. I applaud the announcement. I hope that President Trump’s commitment to Bitcoin is more than political expediency. The most cynical political reason for endorsing Bitcoin is to excite its 60 million American holders by positions that make the “number go up.” But it is my hope that President Trump and the DNC nominee have or will develop a deeper understanding of the earthshaking reasons for America to have a bitcoin strategic reserve.

The more compelling reason is laid out in U.S. Space Force Major Jason Lowery’s MIT thesis called Softwar. Major Lowery points out that Bitcoin has been mischaracterized as money when, in fact, it’s a cyber defense system that will protect our online identities and data in cyberspace. Just as we have an Air Force to protect our skies and a Navy to protect our seas, Bitcoin can protect us in cyberspace. Bitcoin’s potential as a cyber defense weapon is a classic example of an unrecognized use case. Here is an analogous example: The Chinese invented gunpowder and used it as medicine for 200 years before other countries recognized that it was the most potent tool for power projection. Today, the popularly assumed use of Bitcoin is money. But Bitcoin is also a power projection weapon that can protect our currency, and everything that we do online, from cyberattacks. The first country that recognizes this function will be the new global superpower. We need to grab the reins and harness Bitcoin’s full potential if we want to regain and consolidate our title as leader of the free world.

Based on public information, the USA currently owns 204,000 bitcoin, the 5th largest Bitcoin wallet in the world. Adding Bitcoin to that reserve will help secure the future of the USA for the next 250 years. One of my first hires in the Kennedy administration would be Major Lowery as top advisor for my National Security team.

Another important use of Bitcoin for America and the world is the one that is dearest to my heart: capturing carbon and incentivizing green energy production through Bitcoin mining. I served for forty years as an environmental champion and for a decade as a partner at Vantage Point, the world’s number one green technology investment firm. I played key roles in developing some of the world’s latest solar and wind power generators. Critics of Bitcoin have wrongly cast it as an environmental threat because of its high energy demand. The opposite is actually true. Bitcoin miners are more sensitive to energy pricing than any other industry. This means that they can only survive by utilizing the cheapest energy, which invariably means waste energy and surplus power. For example, methane from landfills would otherwise go into the atmosphere. But Bitcoin miners are uniquely able to harness it as an energy source. Bitcoin mining is also the ideal partner of renewable energy and variable power projects like wind and solar. My personal experience in energy project finance left me with a deep appreciation for the critical potential for bitcoin mining as a reliable profit center for renewable energy projects that need flexible, onsite off-peak customers for intermittent energy generation — in order to get financing. Bitcoin miners are the ideal partners for these projects.

Alright, let’s lean in to some of the other ways that Bitcoin is good for Americans. President Nixon took us off the gold standard in 1971 to finance the Vietnam War. Since then, the dollar’s purchasing power has been in precipitous decline, eroding the savings and earnings of everyday Americans. Alan Greenspan, who was Chair of the Federal Reserve for 20 years, even warned that “in the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” Inflation, as we all know, is theft, and it’s almost always theft from the poor. The Fed has engineered an über-efficient money printing machine to perpetuate the systematic robbery that has gutted the American middle class and decimated America’s working poor.

The obscene money printing has drained our citizens of their purchasing power through the hidden tax of inflation. And, it was the Trump and Biden administrations’ reckless embrace of money printing that have pushed the middle class over the tipping point. American households are now buckling under the strain. Let’s look at it simply: if you had $1,000 in your bank account 6 years ago, it only buys $520 worth of goods and services today. Mortgages have doubled in four years. No wonder half of 18- to 30-year-olds are still living at home, unable to afford the homes that provide the first step towards the American Dream. No wonder our younger Americans are marrying later, delaying or even abandoning the choice to start a family. Their dwindling purchasing power forces them into these sacrifices. The hopelessness of the task of steadily growing their savings has pushed them into a kind of financial nihilism and contributed to the epidemics of depression, suicide, and addiction among young Americans.

Healthcare costs are increasing exponentially. I talked with young New Hampshire parents who told me, with tears in their eyes, about holding the crying baby in their arms and wondering if the child was $50 sick or $500 sick before bringing him to the hospital. Over half of Americans can’t put their hands on $1,000 if they have an emergency. If you are in that cohort, and the engine lights come on in your car, it is the apocalypse. You know you won’t be able to pay the mechanic and get to work. This death spiral will inevitably end with you living homeless on the street. Walk outside — you will see the tent encampment populated by armies of Americans who came out on the wrong side of such unplanned expenses. Time and again, I hear from elderly Americans, who are cutting their prescription pills in two to make it through the week, and choosing between food and fuel. Mothers are downgrading ingredients to make it through the checkout line. Americans are forced to make these gut-wrenching decisions because our money is broken.

For the beleaguered American middle class, Bitcoin is the off ramp from the inflation highway of doom. If the world were on a Bitcoin standard, and our money held its value, we would all have the ability to live more abundant lives. Bitcoiners have it right: “Fix the money, fix the world.”

The discipline of tying our dollars to hard assets like Bitcoin will also finally break our addiction to forever wars. Fiat currency was invented to fund wars. As I just pointed out, Nixon got us off the gold standard in 1971 because printing fiat currency was the only way to finance the Vietnam War. Prior to the fiat currency innovation, when a country ran out of money or gold, the war would end. Or, if a government wanted to fund a war, it would issue war bonds and borrow the money from its citizens. Today governments don’t need to even ask permission; they just print the money to fund wars. If the world was on a Bitcoin standard, then there would be no war because governments can’t print Bitcoin. I am a proponent of Bitcoin because it can defund the military-industrial complex that is bent not on national defense but on global domination. Let me say it again: If governments couldn’t print money with a couple of keystrokes on a computer, they wouldn’t be able to fund wars that never end.

Again, fix the money, fix the world.

And make no mistake, one of the main goals of my administration will be to fix our broken money.

To reach that goal, I am going to support making direct ownership of Bitcoin tax-free. The conversion of Bitcoin back into dollars will be a non-reportable transaction to the IRS and not subject to capital gains.

We have to remember that the Fourth Amendment guarantees a right to privacy. As a Constitutionalist, I am an adamant defender of our right to financial and transactional privacy. When U.S. citizens are required to report every Bitcoin transaction to the IRS, the government knows everything that we are doing with our money. Governments have no business knowing YOUR business.

Most importantly, making the direct ownership of bitcoin tax-fee creates a financial incentive to own bitcoin and not a Bitcoin ETF, which is a security and, therefore, subject to capital gains. This is crucial because the direct ownership of Bitcoin keeps it decentralized and will help prevent BlackRock and other global asset managers from having undue influence over the Bitcoin network, forks and upgrades.

In 2014, the IRS declared bitcoin to be property, and regulated its purchase and sale as a capital transaction. It’s important to understand that this tax law was never passed by Congress nor signed into law by the president. The IRS and SEC usurped government power in order to suppress decentralized financial democracy.

The U.S. Supreme Court reversal of the Chevron doctrine reopens this issue. This decision has allowed freedom-fighter Bitcoiners to challenge the constitutionality of taxing Bitcoin for the 2024 tax year.

I’m telling you today, I will never sign a law that taxes direct ownership of Bitcoin. I will use my power to reverse any law that does so. I will end the Biden’s administration’s war on Bitcoin. Tax-free Bitcoin is not only critical for citizens’ financial autonomy, freedom, and privacy, it is essential to keep it decentralized and democratic as Satoshi created it to be.

Finally, Bitcoin guarantees property rights. With freely transactable Bitcoin, no government will be able to confiscate or tax your wealth at the border. This is another example of Bitcoin’s potency as a weapon against totalitarianism.

So, as this election cycle starts to heat up, you have choices to make. You’ve heard what I propose to do. Let’s compare that with my Republican opponent. I welcome President Trump’s new enthusiasm for Bitcoin, but he is only weeks old to the Bitcoin dialogue. My guess is that there will be a lot of talk about price and how Bitcoin can make Bitcoiners rich. But, we all know that is not the point of Bitcoin. Bitcoin is about values. The “price go up” feature is the least of its attributes. President Trump has a long way to go to explain how his personal values align with Bitcoin. If he doesn’t do that, then what assurance do we have that his endorsement is not just another ephemeral monetary policy fad du jour?

That assurance will require him to repudiate some of the central policies of his last administration. During his years in the White House, President Trump has consistently spoken out against Bitcoin. In December of 2020, he was openly hostile to Bitcoin and tried to outlaw self-custody wallets. This was a time when Americans needed any store of value they could get to compensate for the hits to their income and purchasing power due to the Covid shutdowns and the orgy of money printing. In 2021, President Trump doubled down and declared that “Bitcoin, it just seems like a scam. I don’t like it because it’s another currency competing against the dollar.”

I am happy that President Trump has had this evolution. I’m proud that I helped blaze a trail that made it easier by other political leaders to follow. And I’m grateful to the 50–60 million Bitcoiners like Michael Saylor who were there before me, who helped me understand the nation-saving potential of Bitcoin.

Every Bitcoiner I know shares my own yearning for freedom, a skepticism toward official orthodoxies, and that inclination for critical thinking that I so admire.

During Covid, neither President Trump nor President Biden protected our Constitutional rights. They both restricted our right to assemble; to worship; they closed our churches; no funeral for your grandma, no weddings. They closed our businesses without due process and just compensation. They ended the Seventh Amendment right to jury trials. They assaulted the Fourth Amendment prohibition against warrantless searches and seizures. Also, both of their administrations allowed the FBI and spy agencies to suppress our right to free speech by working with social media companies to deplatform people who shared information that the government did not like. I hope that his change of heart in Bitcoin is evidence of President Trump’s newfound and deep-seated commitment to personal freedom and the Bill of Rights.

Will President Trump fight for Bitcoin? I wish he had mentioned Bitcoin in his RNC acceptance speech last week. I’m disappointed that he spent the last week attacking President Bukele and El Salvador, the only country on a Bitcoin standard. Bukele is the most popular president in El Salvador’s history and, with Bitcoin’s help, has turned the country around. Bitcoin has helped him grow their economy and reduce crime. The U.S. should want to take a page from Bukele’s playbook and see what Bitcoin can do for us.

And even more alarming, President Trump, in an interview with Bloomberg last month, floated the idea of bringing in Jamie Dimon as his Secretary of Treasury. I’m grateful that President Trump yesterday walked back that comment. But I’m not sure how he could ever have considered bringing in one of the biggest, long-time Bitcoin critics and the ultimate advocate on centralized control if he truly understands Bitcoin. Those choices just don’t match the freedom and decentralization that Bitcoin represents. I would rather see someone like Michael Saylor or Caitlin Long as Treasury Secretary. They are forward-thinking and represent the ideals of decentralization and economic democracy.

Finally, President Trump had four years to pardon Ross Ulbricht, Julian Assange, and Edward Snowden, but he didn’t. We need to ask ourselves why. I have already looked into these cases and plan on pardoning each of them day one.

In this election year, I encourage you to study your choices. Look at the candidates’s policies, but more importantly, look at their actions to decide if they are part of the problem or the solution. Decide if they align with what you believe Americans need and what America herself needs. Then vote accordingly.

I want to leave you today with a core belief of the Bitcoin community. Bitcoin is the currency of freedom, of liberty, and hope. It restores self-sovereignty back to the individual, it gives us digital property rights for the first time, and it provides a store of value that will allow middle-class Americans to live in abundance. I want to be the president who can bring back hope. I am grateful to be part of your Bitcoin community. In fact, don’t think of me as red. Don’t think of me as blue. Don’t think of me as purple even. Those are the colors of political parties. Instead, think of me as orange — the color that represents hope. It’s true that President Trump has orange hair, a feature that I can only admire from afar. And that’s a great start! But I have an orange heart.

It is my goal to find a way to return unity to politics, the same unity that runs through the Bitcoin community: Each of us is different in thought but united in our larger goals. When I am elected your president in November, I look forward to working with you, and yes, disagreeing with you at times. We must demand discourse over discord. Let’s engage in tough discussion and debate. It is only then, that together, we can bring freedom and hope back to these United States.

Thank you, and God bless!

Wow, the keynote speech was amazing and the crowd and live stream was onboard! Excellent presentation RFK!

No internet, no Bitcoin.

Potential problem, even without using as much electricity as California...

Stand up for Palestinian Human Rights and get my vote, sir.